Table of Contents

- The Expected 2025 Social Security COLA Just Increased – But Here Are 2 ...

- The Expected 2025 Social Security COLA Just Increased – But Here Are 2 ...

- Ssa Income Limits Chart 2024 - Liuka Shannon

- Everything is going to change forever on Social Security benefits in ...

- What the 2025 Earnings Limit Means for COLA Calculations in Social ...

- It's Confirmed: Here's Your Social Security Increase for 2025 ...

- Social Security Max Income Allowed 2024 Chart - Dede Monica

- Treasury Inflation-Protected Securities | TIPS: Perfect investment for ...

- (LIVE) 2025 Social Security COLA Projection – July 11 CPI Release - YouTube

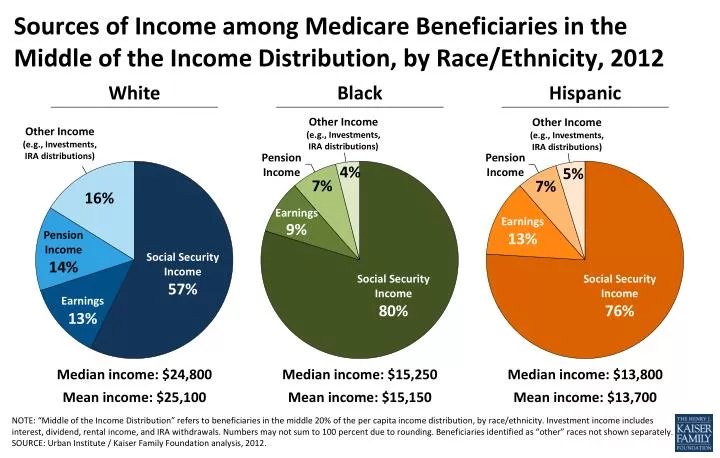

- PPT - Social Security Income 57 % PowerPoint Presentation, free ...

Understanding Tax Inflation Adjustments

Key Adjustments for Tax Year 2025

Impact on Taxpayers

These adjustments will have a significant impact on taxpayers, particularly those in higher tax brackets. The increased standard deduction and exemption amounts will provide relief to many taxpayers, while the adjusted tax brackets will help prevent bracket creep. Additionally, the increased estate and gift tax exemption will benefit high-net-worth individuals and families.

Planning Opportunities

The tax inflation adjustments for 2025 present several planning opportunities for taxpayers. For example: Tax Bracket Management: Taxpayers can take advantage of the adjusted tax brackets to minimize their tax liability. This may involve accelerating or deferring income to take advantage of lower tax rates. Charitable Giving: The increased standard deduction may impact charitable giving strategies. Taxpayers may need to consider alternative strategies, such as bunching donations or using a donor-advised fund. Estate Planning: The increased estate and gift tax exemption provides an opportunity for high-net-worth individuals and families to review and update their estate plans. The IRS tax inflation adjustments for 2025 are designed to keep pace with inflation and prevent unfair tax penalties. Taxpayers should be aware of these changes and how they may impact their tax situation. By understanding the key adjustments and planning opportunities, taxpayers can take proactive steps to minimize their tax liability and achieve their financial goals. As always, it is essential to consult with a tax professional to ensure you are taking advantage of the available tax savings opportunities.This article is for general information purposes only and should not be considered tax advice. Please consult with a qualified tax professional to discuss your specific tax situation.